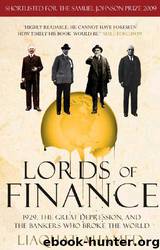

Lords of Finance: 1929, the Great Depression, and the Bankers Who Broke the World by Liaquat Ahamed

Author:Liaquat Ahamed [Ahamed, Liaquat]

Language: eng

Format: epub, mobi

Tags: Economic History, Economics, Banks & Banking, Business & Investing, Industries & Professions

ISBN: 159420182X

Publisher: Cornerstone Digital

Published: 2011-09-28T14:00:00+00:00

FIGURE 5

By 1929, anywhere from two to three million households, one out of every ten in the country, had money invested in and were engaged with the market. Trading stocks had become more than a national pastime—it had become a national obsession. These punters were derisively described by professionals like Jesse Livermore as “minnows.” But while the bubble lasted, it was the people who were the least informed who were the ones making the most money. As the New York Times described it, “The old-timers470, who usually play the market by note, are behind the times and wrong,” while the “new crop of speculators who play entirely by ear are right.”

The city that was most obsessed was New York, although Detroit, home to so many newly enriched “motor millionaires,” came a close second, followed by two other new-money towns, Miami and Palm Beach. The infatuation with the market took over the life of New York City, sucking everything into its maw. As Claud Cockburn, a British journalist newly arrived in America, observed, “You could talk about Prohibition471, or Hemingway, or air conditioning, or music, or horses, but in the end you had to talk about the stock market, and that was when the conversation became serious.” Anyone trying to throw doubt472 on the reality of this Promised Land found himself being attacked as if he had blasphemed about a religious faith or love of country.

As the crowd piling into the market473 grew, brokerage house offices more than doubled—from 700 in 1925 to over 1,600 in 1929—mushrooming across the country into such places as Steubenville, Ohio; Independence, Kansas; Amarillo, Texas; Gastonia, North Carolina; Storm Lake, Iowa; Chickasha, Oklahoma, and Shabbona, Illinois. These “board rooms” became substitutes for the bars shut down by Prohibition—the same swing doors, darkened windows, and smoke-filled rooms furnished with mahogany chairs and packed with all sorts of nondescript folk from every walk of life hanging around to follow the projected ticker tape flickering on the big screen at the front of the office. The grail was to discover the next General Motors, which had risen twentyfold during the decade, or the next RCA, which had gone up seventyfold. The newspapers were full of articles about amateur investors who had made fortunes overnight.

The old crowd on Wall Street had a rule that a bull market was not in full stampede until it was being played by “bootblacks, household servants474, and clerks.” By the spring of 1928, every type of person was opening a brokerage account—according to one contemporary account, “school teachers, seamstresses, barbers, machinists, necktie salesmen, gas fitters, motormen, family cooks, and lexicographers.” Bernard Baruch, the stock speculator who had settled down to a life of respectability as a presidential adviser, reminisced, “Taxi drivers told you what to buy475. The shoeshine boy could give you a summary of the day’s financial news as he worked with rag and polish. An old beggar, who regularly patrolled the street in front of my office, now gave me tips—and I suppose spent the money, I and others gave him, in the market.

Download

Lords of Finance: 1929, the Great Depression, and the Bankers Who Broke the World by Liaquat Ahamed.mobi

This site does not store any files on its server. We only index and link to content provided by other sites. Please contact the content providers to delete copyright contents if any and email us, we'll remove relevant links or contents immediately.

| Africa | Americas |

| Arctic & Antarctica | Asia |

| Australia & Oceania | Europe |

| Middle East | Russia |

| United States | World |

| Ancient Civilizations | Military |

| Historical Study & Educational Resources |

Cat's cradle by Kurt Vonnegut(15315)

Pimp by Iceberg Slim(14471)

4 3 2 1: A Novel by Paul Auster(12359)

Underground: A Human History of the Worlds Beneath Our Feet by Will Hunt(12078)

The Radium Girls by Kate Moore(12007)

Wiseguy by Nicholas Pileggi(5757)

The Fire Next Time by James Baldwin(5418)

Perfect Rhythm by Jae(5389)

American History Stories, Volume III (Yesterday's Classics) by Pratt Mara L(5290)

Paper Towns by Green John(5168)

Pale Blue Dot by Carl Sagan(4988)

A Higher Loyalty: Truth, Lies, and Leadership by James Comey(4942)

The Mayflower and the Pilgrims' New World by Nathaniel Philbrick(4482)

The Doomsday Machine by Daniel Ellsberg(4477)

Killers of the Flower Moon: The Osage Murders and the Birth of the FBI by David Grann(4431)

The Sympathizer by Viet Thanh Nguyen(4379)

Too Much and Not the Mood by Durga Chew-Bose(4324)

The Borden Murders by Sarah Miller(4302)

Sticky Fingers by Joe Hagan(4179)